How to Build Wealth on a Teaching Salary

It's not your fault you were never taught to invest. But you need to learn how if you want to build wealth that lasts.

With the right system in place, financial freedom is possible - even on your teaching salary.

Perfect for teachers who want to start investing - even if you’re totally new and feel overwhelmed.

YES! I'M READY TO BUILD WEALTH AS A TEACHERAre you ready to finally take control of your money - and start building wealth TODAY?

MONTHLY PAYMENT PLAN

3 PAYMENTS OF $180

REG. PRICE $1197

MONTHLY PAYMENT PLAN

3 month plan

Same full access, smaller payments!

Imagine what's possible...

-

Never worrying about retirement again

-

Having true time freedom to enjoy life outside the classroom

-

Watching your investments grow automatically

-

Feeling empowered and confident with your money

-

Creating generational wealth for your family

This course is for you if...

✅ You’re a busy teacher who wants a simple, stress-free way to invest - without adding another job to your plate.

✅ You’re tired of hidden fees and want to finally keep more of your hard-earned paycheck.

✅ You know you should be investing, but you feel overwhelmed and don’t know where to start.

✅ You’re ready to start building wealth and creating real financial freedom, even on a teacher’s salary.

✅ You already have some investments but aren’t sure if you’re “doing it right.”

✅ You have money sitting in savings and want to make it work harder for you.

✅ You’ve tried learning about investing before, but it felt confusing and overwhelming.

✅ You don’t want to wait until you’re 65 to retire — you want freedom and flexibility now.

And you're tired of...

- Feeling like you work too hard to have so little to show for it.

- Advisors who talk in circles and make investing sound harder than it is.

- Watching your paycheck disappear while fees eat away at your future.

- Trying to piece everything together from YouTube videos and Facebook groups.

- Feeling behind when you know you’re doing your best.

- Wondering if financial freedom is even possible on a teacher’s salary.

It doesn’t have to feel this way anymore!!!

My Financial Edge method shows you exactly how to take control of your money, invest confidently, and finally feel in charge of your financial future.

What you'll learn inside

✅ How I’ve built my Net-Worth to over $530k (even on my 60k salary)

✅ How to invest in low-cost, diversified index funds (and where to buy them to avoid hidden fees!)

✅ How to buy a stock with $1. Yes, that’s all you need to get started!

✅ Setting up money systems that automate your monthly investments for you

✅ How to minimize your fees, research expense ratios, and get out of a high fee vendor

✅ How to optimize your pension, social security, and long-term investment portfolios so they continue to build wealth even after you stop contributing! (Critical if you want passive income)

Normally $1197

Join today for only $497!

And it’s not just theory!

This investing system is already changing teachers’ lives.

Real Teachers

Real Results.

Because I learned how to invest my money,

my accounts made over $62,000 passively last year.

That is more than my annual teaching salary!!

*Screenshots for proof*

OKAY, TEACH ME HOW!!Hi there! 👋 I'm Rachel

I’m a full-time classroom teacher who built a net worth of over $530,000 - all while grading math tests, coaching track, and raising two little boys.

Like most teachers, I used to think financial freedom wasn’t possible for us. Then I discovered my “trusted” 403(b) advisor had been charging thousands in hidden fees. That wake-up call changed everything.

I learned how to invest in low-cost index funds, automate my finances, and build wealth on autopilot - and now I teach other educators how to do the same inside Financial Edge for Teachers.

Because teachers deserve more than appreciation. We deserve freedom.

Freedom to create a life where you can say yes to time, travel, and the things that light you up.

Financial freedom is waiting - and I can’t wait to help you make it happen.

Let's do this!BTW, can this work if I don't have a ton of time or money?

Absolutely! I created this program specifically for busy teachers.

Even if you only have an hour a week, you can make real progress - the system is designed to run in the background of your life. But remember, the longer you wait, the less time your money has to grow.... and time is the most powerful wealth-building tool you have.

Start now, even small. Your future self will thank you. 💛

So, what exactly is inside?

I'm glad you asked!

Module 0

Mastering your Money Mindset

- Uncover the impact of past money traumas

- Embrace money as a tool for freedom

- Transform scarcity into abundance

Module 1

Compound Interest

- The math behind compound interest

- Teacher case studies

- How capital gains work

- The difference between saving and investing

- How to make compound interest work FOR you

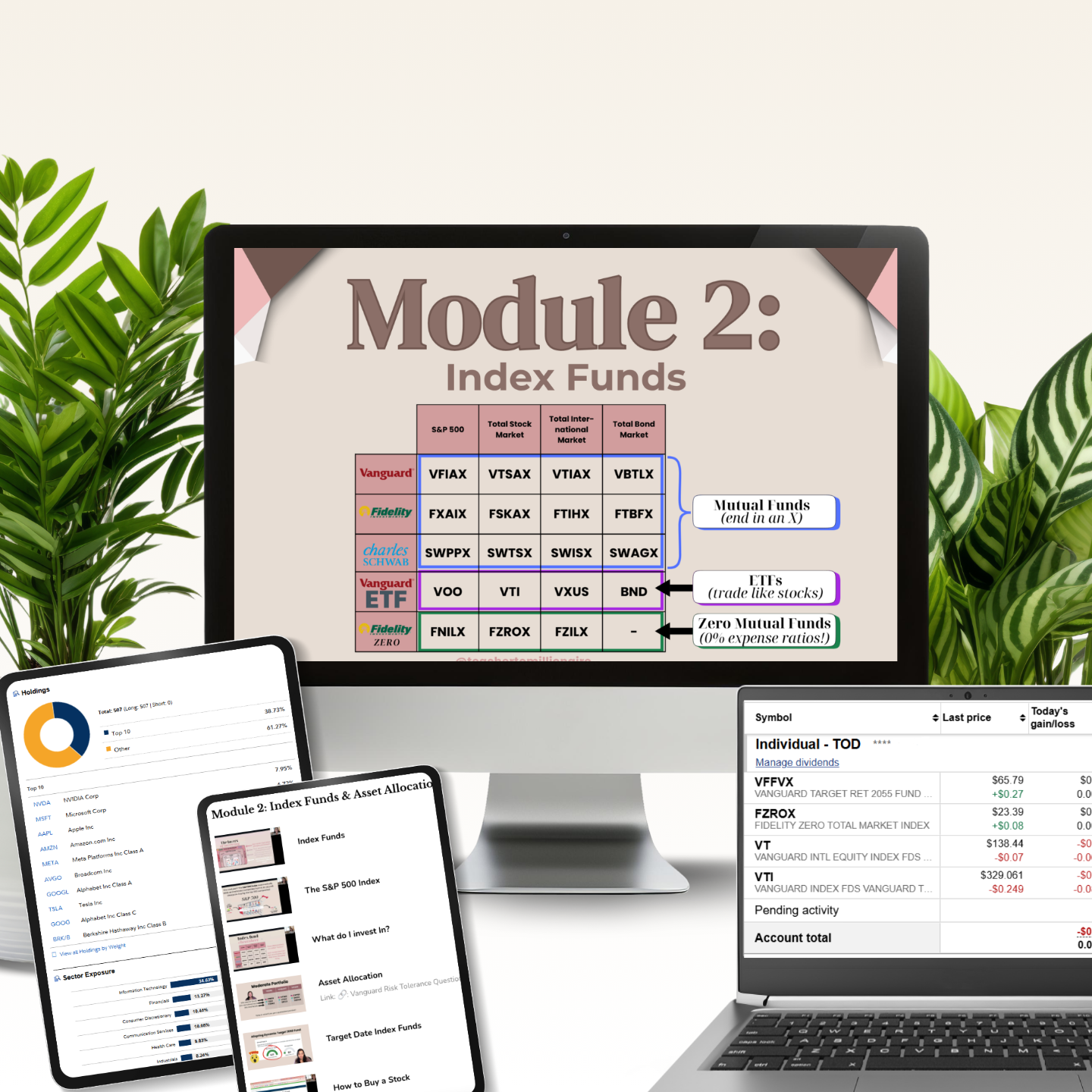

Module 2

Index Funds

- What an index fund is

- Why they’re the most efficient way to build wealth

- How the S&P 500 works

- The best index funds to buy

- Key ticker symbols you need to know

- What is an expense ratio

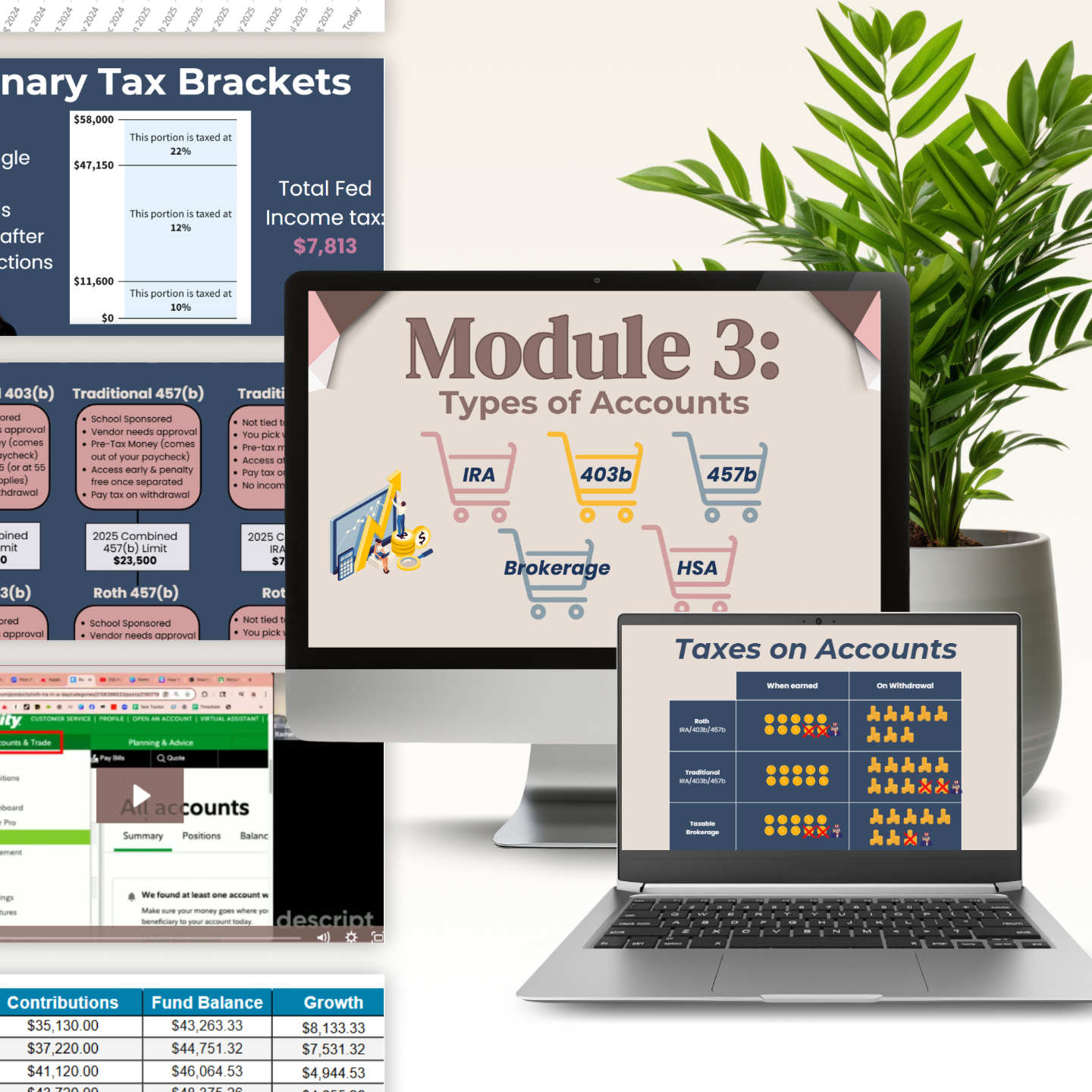

Module 3

Types of Retirement Accounts

- The key differences between 403(b), 457(b), and IRA accounts

- How brokerage and HSA accounts work

- The tax implications of each account

- How to open a Roth IRA

- Withdrawal strategies and age restrictions

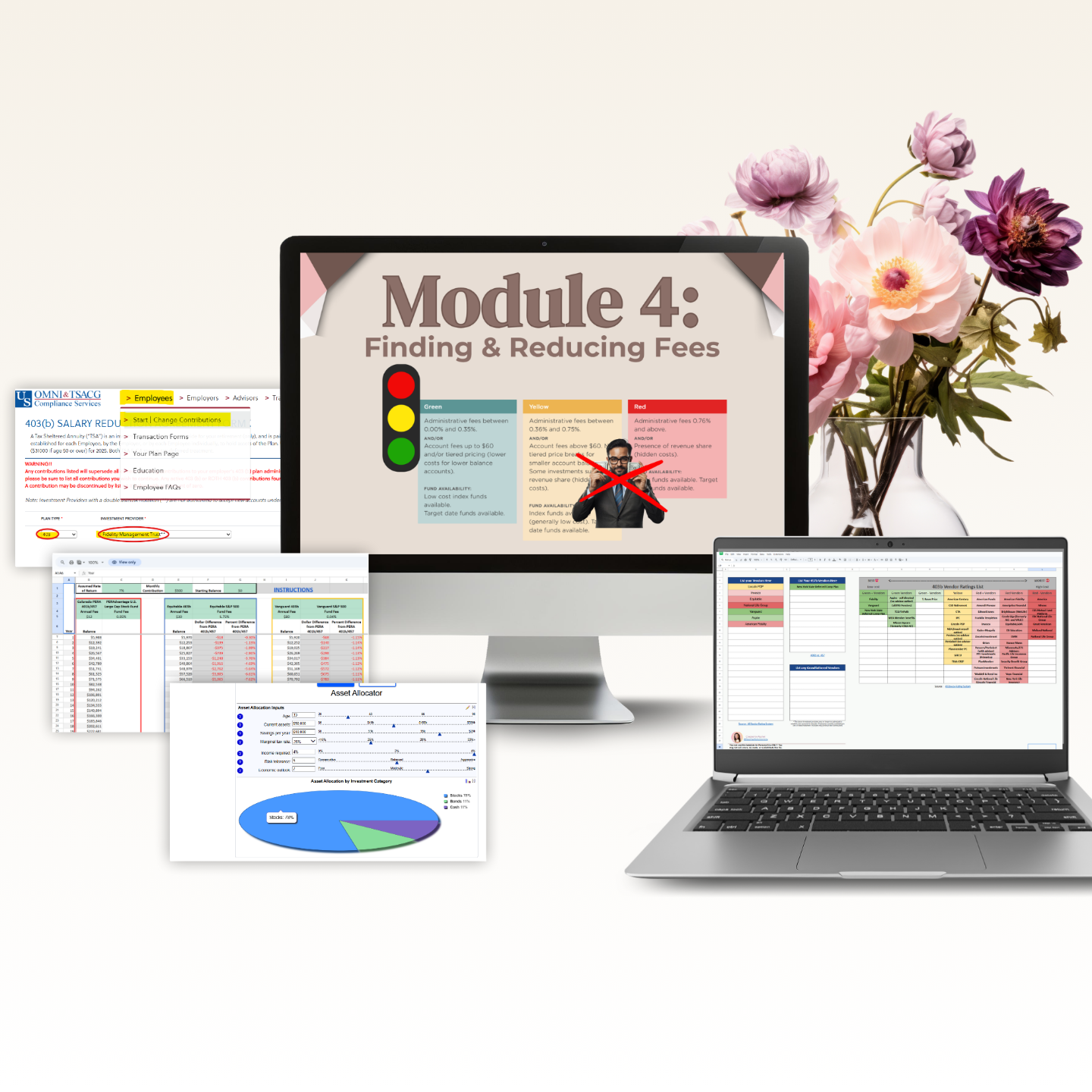

Module 4

Finding and Reducing Fees

- Understand how financial advisors get paid

- Check if you’re working with a high-fee vendor

- Find and understand your expense ratios

- Calculate fees in your Roth IRA and 403(b)

- Apply for a new 403(b) vendor

- Fill out a Salary Reduction Agreement (SRA)

- Transfer out of a high-fee vendor

+ PLUS: My exact script to dump a financial advisor

Module 5

How to Automate your Investments

- How to pay yourself first

- Why automating your finances is essential

- What Dollar Cost Averaging is

- Why we don’t time the market

- Step-by-step setup for automation

Module 6

Your Financial Independence Number

- Determine Your Retirement Target

- Understand the 4% Rule

- Calculate Your Personalized FI Number

- Integrate Your FI Number into Retirement Planning

+ PLUS Access My FIRE Spreadsheet

Module 7

Pension & Social Security

- Find your pension factor

- Calculate your estimated pension

- Understand Social Security eligibility

- Learn how pensions and Social Security affect your FI Number

+ NEW : WEP and GPO repeals explained!

Module 8

Living the Teacher's Edge

- Create a personalized investing plan

- Align your investment allocations

- Map out your dreams by decade

- See what’s truly possible for you

Frequently Asked Questions

Q: Are results guaranteed?

Q: Is this course suitable for beginners with no prior investing knowledge?

Q: I'm on a tight budget. How can I be sure that investing in this course will be worth the cost?

Q: How much time do I need to dedicate to the course and implementing the strategies?

Q: Can this course help me reduce fees in my retirement accounts?

Ready to take control of your financial future?

30-DAY MONEY-BACK GUARANTEE

I believe in this program so much that if you don't feel more confident about investing after taking this course, I will issue a full refund. I want to make you wealthy, not sell you something you don't want! Just email Rachel at [email protected] directly for a refund.